Luxury real estate has evolved from high price tags and fuses culture, innovation, and investment strategy in today’s contemporary world. It reflects global wealth patterns that define the most desirable cities.

Scattered across the iconic metropolises in the world, luxury property markets are shaped by dynamic lifestyle expectations, new financial patterns, and urban reinvention. High-net-worth individuals and investors increasingly chase high-end properties not because of their prime locations, but due to its architectural distinction and lifestyle services.

Whether a savvy investor is looking for a bespoke island mansion or a boutique, waterfront penthouse, today’s luxury real estate offers a deeper narrative about city urbanization and global wealth flows.

Features of Luxury Real Estate- Icons Beyond Price

Various attributes define the core of luxury real estate in global cities:

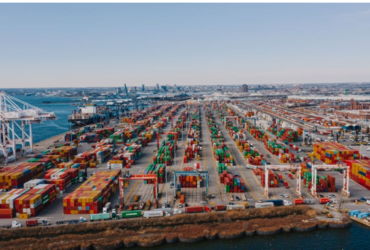

- Scarcity – Limited inventory in sought-after urban locations or waterfront nodes.

- Prestige –High-end units in coveted districts with cultural marks or premier brand association.

- Amenities & Lifestyle –Excellent security, concierge services, and resort-style provisions surpassing extravagance.

- Investment Value –Limited availability promises capital appreciation and preservation.

These characteristics play a critical role and mirror why certain cities excel others in attracting global capital.

Global Luxury Real Estate Powerhouses

Dubai: A Jewel in the Desert

Dubai’s luxurious residential segment has redefined what a newcomer city can achieve. It now rivals long-established markets like New York and London.

Market Acceleration & Sales Dominance

| Metric | Statistic |

| Surge in luxury real estate prices (2019-2024) | 147% rise – among highest globally |

| Super-prime ($10M+) sales (2024) | 435 transactions – higher than NY and London combined |

| Q1 2025 Ultra-Luxury Sales | 111 properties sold – record high |

Why Dubai is Leading Global Luxury Real Estate

Strategic Brand Collaborations & Partnerships

From lifestyle to fashion and automotive, Dubai’s luxury real estate segment is an exhibition of prestigious structures. Besides global premier brands, world renowned actors are sprinkling their legacies. This pioneers a new era of luxury real estate anchored by partnerships.

Top Branded Projects in Dubai (Off-Plan + Ready)

Top branded projects in Dubai are a perfect example of how top, notch skills are combined with globally recognized brands, thus setting a higher standard for luxury real estate. These homes that are directly linked to the names of fashion houses or car manufacturers are a symbol of luxury and exclusiveness.

- Shahrukhz by Danube

- Mercedes Benz Places by Binghatti

- Orla by Dorchestor Collection

- Armani Beach Residences

Master Planned Super-Luxury Communities

Dubai’s consistent unveiling of upscale luxurious communities add a distinctive edge to its high-end real estate segment. Examples include:

- Dubai Mansions – A staggering master project is planned to engulf Dh 100 billion for lining up tens of thousands of luxury homes.

- The Heights Country Club & Wellness –Set at the apex of luxury living, this bespoke luxury community plans to engulf Dh 55 billion. Planned over an 81 million square feet area, the community will host luxurious semi-detached villas and curated townhouses.

New York & Miami: Shift in the American Luxury Landscape

New York is widely regarded for its established presence in the luxury real estate landscape. Neighborhoods, particularly Billionaire’s Row, are characterized by trophy skyscrapers and owned by the world’s most affluent personalities.

However, recently luxury ecosystem of US has converted its attention towards:

- The Hamptons witnessed a record-setting increase in luxury prices as well as in total sales from 2024 to 2025, fueled by market demand and robust financial gains.

- Miami surpassed New York City in active homes’ listings priced around and above $1 million by late 2025, with Miami listing 10,591 such properties.

Shift Catalysts

- Limited inventory and construction costs in Manhattan pushed buyers toward secondary and more premium markets.

- Tax considerations, surge in remote work, and warm-climate appeal are targeting wealthy buyers to coastal markets.

European Markets: A Collision of Tradition & New Expectations

European capitals, including Paris and London, are long known for its prestigious real estate symbolizing their cultural heritage. Paris offers a blend of Haussmannian designs with contemporary luxury elements. In contrast, London enlivens its neighborhoods through the combination of global connectivity and heritage architecture.

Signature Characteristics Defining Europe Luxury Market

- Historic neighborhoods with preserved architecture.

- Continued demand for rental luxury, typically tied to diplomatic pockets and international corporate.

- Closeness to art institutions, finance, and elite education make them enduring choice for ultra-high-net-worth individuals.

Hong Kong: A Vertical Luxury Identity

Asia’s prime market, Hong Kong stands out for its sweeping harbor views and historical balance of scarcity and luxury.

- High-end enclaves like Jardine’s Lookout feature record-breaking expansive homes globally.

- The Cullinan in Union Square symbolizes ultra-luxury craftsmanship in the region.

Emerging Luxury Nodes: A New Generation of Prestigious Cities

While traditional markets retain resilience, other cities are also stepping into the spotlight:

Mumbai: Ultra-Luxury Surge

Neighborhoods like Worli now stand among the world’s most high-end communities, with premium pricing now rivaling Manhattan homes. This unprecedented surge in luxury properties reflects India’s domestic investment appeal and wealth concentration.

Manila & Seoul: Staggering Luxury Real Estate Growth

While Manila posted nearly 18% gains in prime segments, Seoul led the market with 18.4% growth in luxury prices. These record-breaking gains signal strong regional momentum.

Key Trends Shaping the Future Luxury Real Estate Landscape

Technological Integration

PropTech solutions, digital property transactions, and smart home features are taking over luxury experience expectations.

Luxury as an “Inevitable” Asset

Global investors looking for portfolio diversification now view luxury properties as a valuable asset for wealth preservation.

Wellness & Sustainability

Global investors are increasingly captivated toward energy-efficient homes, wellness-centric layouts, and eco-certified standards.

Closing In!

Luxury real estate in iconic cities was previously anchored by exclusive prices. But in today’s world, the convergence of lifestyle demands, global capital flows, and strategic investment value create fundamentals for high-end properties worldwide.

As buyer priorities evolve and emerging markets stair up in the spotlight, experience, technology, and sustainability are coming to the forefront as key real estate trends. This shows the continued evolutions of luxury living based on lifestyle aspirations.

Dubai, alone, is a standout example of how branding, foreign capital, and policy can forge new global leaders in the luxury landscape. But traditionally established powerhouses like Paris, London, and New York continue to appeal to elite buyers due to their enduring prestige and cultural panoramas.